Everything You Need for Payment Success

Powerful features designed to simplify payments and accelerate your business growth

Why Choose Davspay?

Accept UPI payments seamlessly and boost your platform with our powerful payment gateway solution.

Instant Payment Collection

Collect payments instantly via UPI from all major apps with seamless integration.

Secure & Compliant

RBI-certified platform with bank-grade security and PCI DSS compliance.

Higher Success Rates

Achieve 98%+ transaction success rates with our optimized payment flows.

Real-time Settlements

Get funds settled instantly without waiting for T+2 days.

Instant Settlements

Get your money in real-time with our instant settlement feature. No more waiting days for your funds.

- Real-time processing

- T+0 settlements

- Automated reconciliation

Bank-Grade Security

Military-grade encryption and PCI DSS compliance ensure your transactions are always secure.

- 256-bit encryption

- PCI DSS certified

- Fraud detection

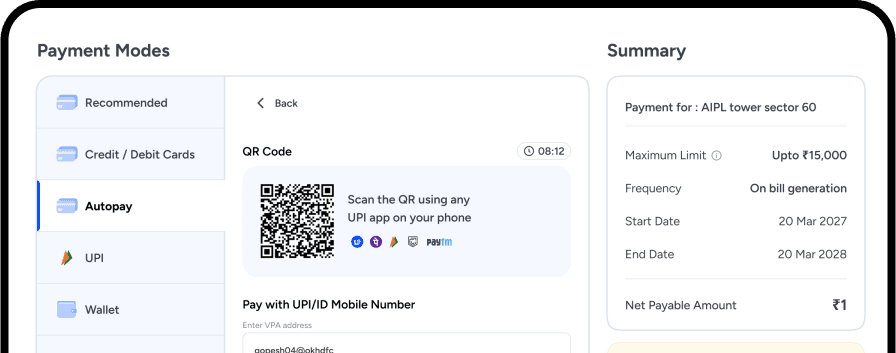

UPI Integration

Seamlessly accept payments through all major UPI apps including PhonePe, Google Pay, and Paytm.

- All UPI apps supported

- QR code generation

- Intent-based flows

Multiple Payment Methods

Support for cards, net banking, wallets, and UPI - all through a single integration.

- Cards & Net Banking

- Digital wallets

- EMI options

Developer-Friendly APIs

Clean, well-documented REST APIs with SDKs for all popular programming languages.

- RESTful APIs

- Webhooks support

- Comprehensive docs

Advanced Analytics

Real-time dashboards with detailed insights into your payment metrics and customer behavior.

- Real-time reports

- Custom dashboards

- Export capabilities

Compliance Ready

Fully compliant with RBI guidelines and all Indian payment regulations.

- RBI compliant

- GST invoicing

- Audit trails

24/7 Support

Round-the-clock technical support to help you with any integration or operational issues.

- Live chat support

- Email & phone

- Dedicated account manager

Trusted by 1600+ Businesses

See what our customers have to say about their experience with Davspay

"Davspay has transformed our payment experience. The integration was seamless, and our payment success rate improved from 85% to 98%. The instant settlements have significantly improved our cash flow."

Rajesh Kumar

Founder & CEO, ShopKart India

"The API documentation is excellent and the developer support team is incredibly responsive. We integrated Davspay in just 2 days and have been processing thousands of transactions smoothly ever since."

Priya Sharma

CTO, EduTech Solutions

"We've been using Davspay for our grocery delivery platform for 6 months now. The UPI integration is flawless, and customers love the quick checkout process. Highly recommended!"

Amit Patel

Director, FreshMart Online

"The dashboard analytics are comprehensive and help us make data-driven decisions. The fraud detection system has saved us from multiple suspicious transactions. Excellent service!"

Sneha Reddy

Product Manager, FinServe

"Switching to Davspay was the best decision for our travel booking platform. The transaction fees are competitive, and the 24/7 support team is always there when we need them."

Vikram Singh

Co-founder, TravelBuddy

"As a healthcare platform, security is our top priority. Davspay's PCI DSS compliance and bank-grade encryption give us and our patients complete peace of mind."

Ananya Iyer

Operations Head, MedCare Plus

Frequently Asked Questions

Find answers to common questions about Davspay payment gateway

Experience Seamless Payments